Quite recently, an unfortunate fire engulfed the buildings of Merrimac Paper Co. in Lawrence, that had been for long supplied paper for National Geographic. New England’s traditional industries seem to give in to forces of technology and rapid globalization.

This fire massacre can be thought of as a symbol of fate of New England’s industries that have been traditional for a century, bowing down to rapid technological progress and globalization. It is generally believed that with the advancement of the digital platform and stiff competition from offshore countries, the number of paper mills in the region is on the decline.

However, papermaking continues to play an important role in rural economies, where paper mills are the only large employers. They also back several other processes as logging, transportation and warehousing. It is also true that the industry incurs rising power costs, tighter environment regulations and last but not the least – China emerging as a manufacturer of paper and paper products.

The industry still faces immense challenges, including the rising cost of electricity, ever stricter environmental regulations, and the emergence of China as major manufacturer of paper and paper products. But those New England companies that have survived expect to stay in business for quite some time.

“This is a very capital intensive business and one that’s always changing,” said Morris Housen, co-owner and chief executive of Erving Paper Mill, which still rolls out 40,000 tons of napkin-grade tissue a year. “But we ride the waves and we’ll survive. It’s a very cyclical business, with lots of ups and downs, but it’s always been that way.”

Companies in any industry that has grown over time are the ones which have understood the advantages of adapting to changing needs of the industry and more importantly to changing demands, changes in tastes and preferences, etc.

In Bennington, N.H., the nearly 200-year-old Monadnock Paper Mills Inc. once made specialty papers for vacuum cleaner bags. But today it is riding a growing sustainability movement that disdains plastic by making biodegradable packaging, hotel key cards, and other products out of paper.

“Being environmentally friendly can be profitable,” said Richard Verney, the chief executive.

Hollingsworth & Vose Co., owner of two mills in Walpole and Groton, are no longer into pulp and paper products, to be exact. Instead, it uses microfiber glass, Kevlar fibers, and other materials to make paper-like products that are used for filters in trucks, computers, hospital clean rooms, semiconductor plants, and heating and ventilation systems.

“Many mills are trying to focus on various specialty materials, but it takes many, many years to make the switch,” said chief executive Val Hollingsworth, whose company employs 350 people at its two Massachusetts mills and about 1,200 workers worldwide. “It takes a lot of patience, investment, and research. It’s not easy, but it can be done.”

The pulp and paper industry has followed the foots-steps of the larger companies: though there has been a fall in number of jobs and many a number of mills have shut down, gradual consolidation and automation have resulted in better productivity and hence more output.

In the mid-1960s, US mills produced 43.5 million tons of paper and pulp. By 2000, production peaked at about 96 million tons due to a growing global population and surge in demand sfor computer-printer and fax-machine paper in the 1980s and ’90s, that defied predictions of a coming paperless society.

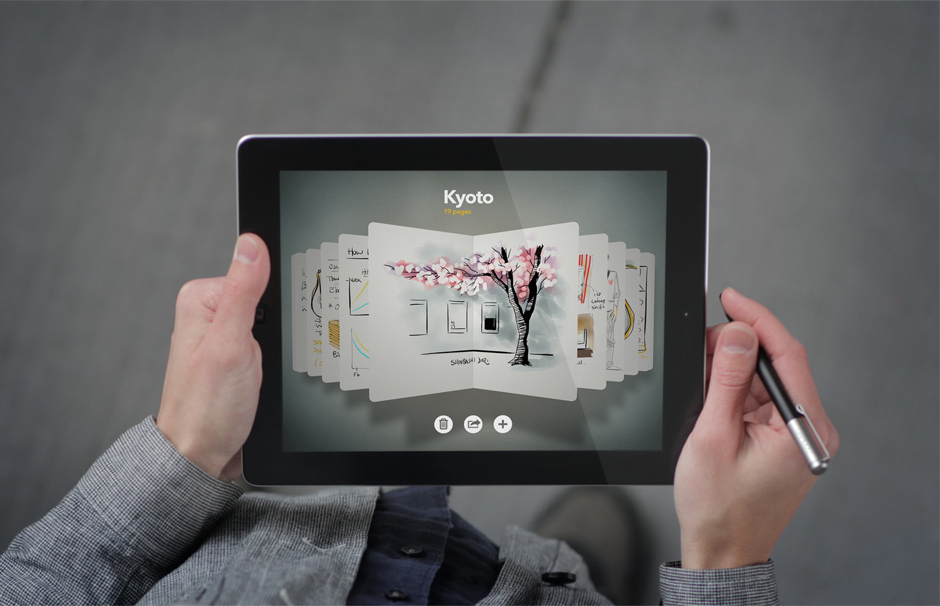

However, such forecasts are becoming increasingly true, placing bigger challenges and threats to the industry as more and more people and especially the young, switch preferences to smartphones and tablets for reading as well as writing.

US paper and pulp production fell to about 82 million tons in 2012, with the biggest declines occurring in paper made for newspapers, magazines, and writing, said Greg Rudder, editor of Pulp & Paper Week, an industry publication owned by Risi Inc. of Bedford.

Still, paper-makers have found new opportunities in an Internet-driven world. That includes the Kraft Group.

Best known as the owner of the New England Patriots, the Kraft Group also includes a number of paper-related units, including Rand-Whitney Containerboard, which manufacturers liner board, or the brown paper that surrounds corrugated boxes. The increase in e-commerce — and the corresponding jump in products delivered via old-fashioned mail — has proved a boon for the company, said Jonathan Kraft, president of the Kraft Group.

The firm’s mill in Montville, Conn., for instance, makes about 250,000 tons of liner paper a year — and all of it from recycled paper, Kraft said.

“The digital world has actually been a plus for us,” said Kraft. “Packaging-grades (of paper) have not seen the huge drop off that newsprint has seen.”

The ability to adapt to dynamical markets and notice product niches, moreover as modernised paper mills and an extremely trained force, could lead on to a additional stable setting for the United States paper business, said Rudder.

He additionally noted that the US has a lot of forests and wood that provides it a bonus over alternative countries.

Maine, one amongst the foremost heavily wooded states, remains the nation’s second-largest producer of paper and pulp, behind.The bottom line, business officers say, is that the manufacturing plant survivors will still survive, despite several challenges, as long as they’ll adapt to plug changes.